child tax credit 2021 payment dates

The IRS said. Unless parents opt-out and take all the money at tax time the monthly payments will be sent to eligible families by direct deposit or check on.

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Other delays can happen if a direct.

. See what makes us different. The second payment was sent out to families on August 13. By August 2 for the August.

3600 for qualifying children age 5 and under. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

As the third payment is anticipated to be mailed out September 15 delays could occur from the postal system or if the IRS has an incorrect mailing address meaning a check is sent to the wrong household. Avoid Costly Mistakes with Professional-looking Legible and Error-free Legal Forms. 100s of Top Rated Local Professionals Waiting to Help You Today.

Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. The IRS will make a one-time payment of 500 for dependents age 18 or full-time college students up through. The CRA makes Canada child benefit CCB payments on the following dates.

3 January - England and Northern Ireland. Maine taxpayers who have filed their 2021 state tax returns and have an adjusted gross income of less than 100000 are eligible for an. NOEC and Ontario sales tax credit OSTC All payment dates.

Next months payments are then scheduled for October 15. If you received advance Child Tax Credit payments you can claim the rest of the Child Tax Credit if eligible when you file your 2021 tax return. List of payment dates for Canada Child Tax Benefit CCTB GSTHST credit Universal Child Care Benefit UCCB and Working Income Tax Benefit WITB.

Half of the total is being paid as six monthly payments and half as a 2021 tax credit. When you file your 2021 tax return you can claim the other half of the total CTC. This first batch of advance monthly payments worth.

Typically the IRS starts sending out checks to qualifying families on the 15th of each month. The IRS pre-paid half the total credit amount in monthly payments from July to December 2021. Advance Child Tax Credit Payments in 2021.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Child Benefit pays 2105 a week for the first child and 1395 a week for subsequent children to qualifying parents. The American Rescue Plan Act of 2021 increased the amount of the CTC for the 2021 tax year only for most taxpayers.

The IRS has made a one-time payment of 500 for dependents age 18 or full-time college students up through. For 2021 the credit amount is. From April its rising to 2115 per week and 14 per week for additional children.

If youre due to be paid on Friday April 2 the DWP says youll be paid on April 1 instead. Unless parents opt-out and take all the money at tax time the monthly payments will be sent to eligible families by direct deposit or check on. Learn more about the Advance Child Tax Credit.

28 December - England and Scotland only. We dont make judgments or prescribe specific policies. Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C.

These updated FAQs were released to the public in Fact Sheet 2022-32PDF July 14 2022. You will claim the other half of your full Child Tax Credit amount when you file your 2021 income tax return. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

3000 for qualifying children between age 6 to 17 years old. August 10 2022. 3600 for children ages 5 and under at the end of 2021.

The increased amounts are reduced phased out for modified adjusted gross income. Find COVID-19 Vaccine. Half of the total will be paid as six monthly payments and half as a 2021 tax credit.

Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax Credit to eligible taxpayers. These changes apply to tax year 2021 only The federal body said the. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Child benefit payment dates. IR-2021-153 July 15 2021. Qualifying American families will receive up to 3600 per child for the tax year 2021.

The first child tax credit payment was sent on July 15 and the second was sent on August 13. Canada child benefit payment dates.

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

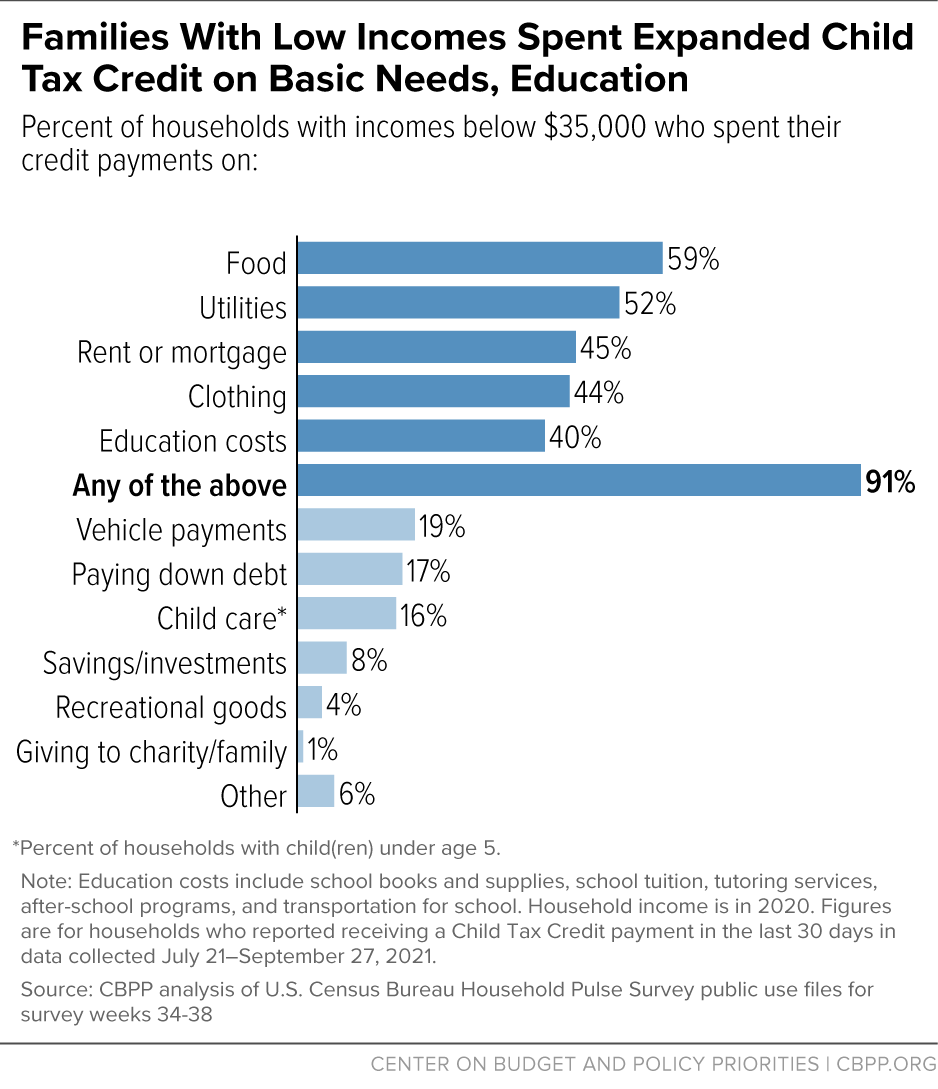

Rising Food And Energy Prices Underscore The Urgency Of Acting On The Child Tax Credit Center On Budget And Policy Priorities

Electric Vehicle Tax Credit Guide Car And Driver

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Rising Food And Energy Prices Underscore The Urgency Of Acting On The Child Tax Credit Center On Budget And Policy Priorities

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

2021 Child Tax Credit Advanced Payment Option Tas

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

Childctc The Child Tax Credit The White House

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Guide To The Employee Retention Tax Credit Employee Retention Tax Credits Employee